AI Compliance in Pharma: Regulatory Risks, Monitoring Frameworks, and Governance Models

Prevent risky AI outputs before they ship. Set up continuous compliance monitoring with guardrails, audit trails, and real-time exception handling.

Pharmaceutical companies invested over $22 billion in Patient Support Programs in 2024. Yet here's the paradox: only 3-8% of eligible patients actually use these services. This massive gap reveals both the untapped potential and strategic importance of PSPs in modern pharmaceutical commercialization.

Patient Support Programs are structured initiatives that help patients access, initiate, and maintain prescribed therapies through services extending far beyond medication dispensing.

Unlike Risk Evaluation and Mitigation Strategies (REMS), which are FDA-mandated safety programs focusing on specific risks, PSPs are voluntary manufacturer-sponsored programs emphasizing patient access and adherence. They also differ from simple Patient Assistance Programs (PAPs), which primarily provide financial aid. PSPs encompass comprehensive support ecosystems including clinical case management, insurance navigation, adherence programs, and patient education.

The simple answer: PSPs drive both patient benefit and commercial outcomes. They directly impact revenue while addressing genuine patient needs in increasingly complex healthcare systems.

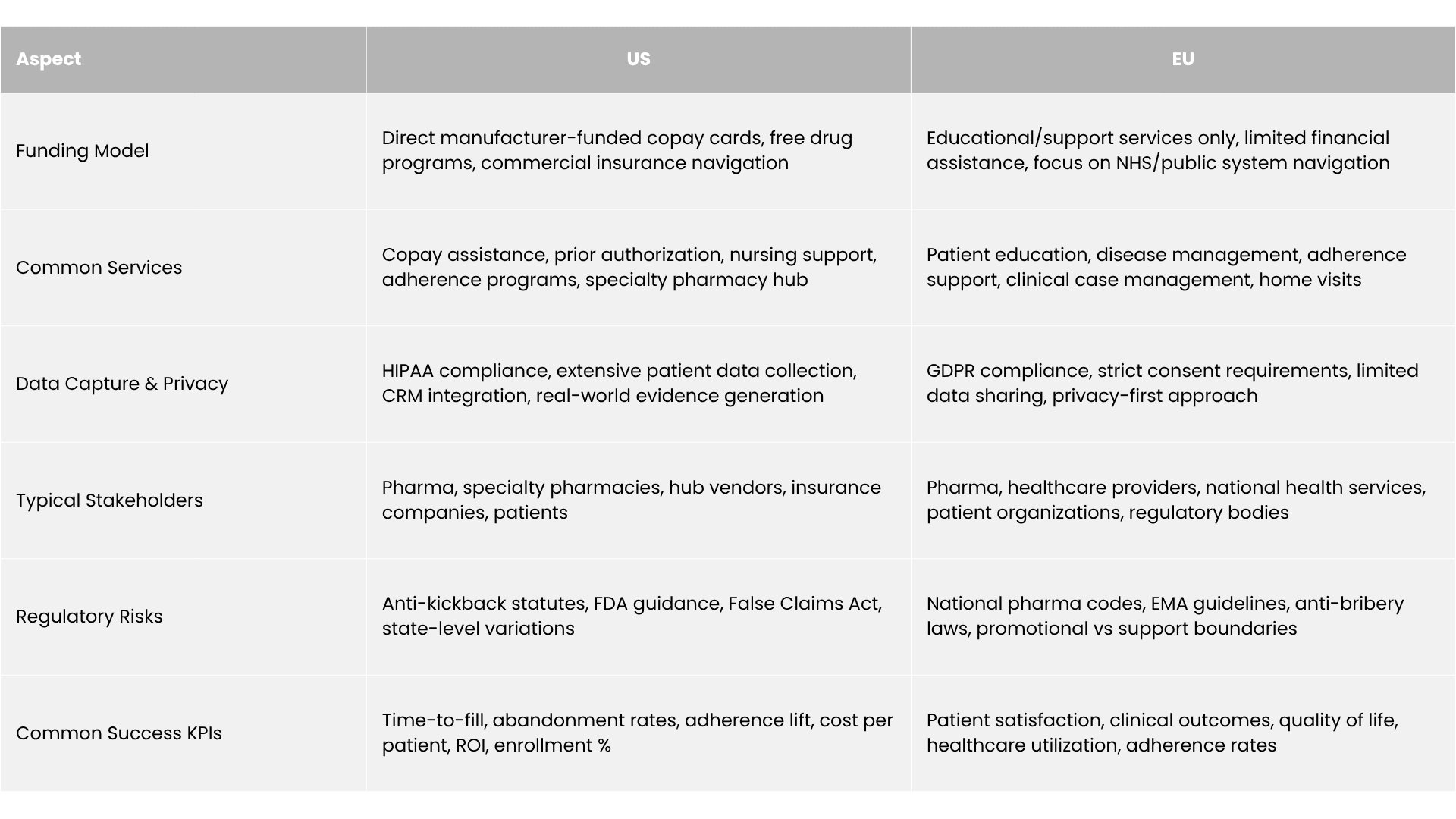

But the way PSPs are designed differs dramatically between the US and the EU due to regulatory frameworks, reimbursement systems, and data privacy requirements.

The US healthcare system’s complexity means PSPs focus heavily on insurance navigation and financial support.

The US system's reliance on private insurance creates substantial administrative burden. Prior authorization requirements affect 91% of specialty medications, with approval processes taking 2-5 business days and denial rates reaching 25-30%. PSPs address this through dedicated case managers who navigate insurance verification, prior authorization submissions, and appeals processes.

Hub services or integrated platforms coordinating patient, provider, and payer interactions cut time-to-therapy by 5-6 days on average.

High-deductible health plans affect 42% of US workers, creating significant financial barriers even for insured patients. PSPs directly address this through copay cards, which can reduce patient out-of-pocket costs from $500-2,000 monthly to $5-25.

AbbVie's HUMIRA Complete program demonstrates measurable impact: patients enrolled in the PSP showed 69% treatment persistence at 12 months versus 55% for non-participants. After 36 months, PSP participants maintained 46% persistence compared to 34% in control groups, translating to sustained medication adherence and revenue protection.

Specialty medication launches face increasing formulary restrictions and step therapy requirements. PSPs provide competitive differentiation when clinical profiles are similar. Companies report that robust PSP offerings influence 15-25% of prescriber decisions when choosing between therapeutically equivalent options.

European PSPs face tighter compliance restrictions but thrive in education and outcomes measurement.

The newly updated EFPIA Patient Solutions Guidelines (December 2024) establish clear boundaries for PSP activities across EU member states. Key requirements include:

GDPR compliance requirements mandate explicit patient consent and data minimization, limiting commercial data collection compared to US programs. However, European PSPs excel at generating real-world evidence for health technology assessments and payer negotiations.

Programs focus on clinical outcome measurement, quality of life improvements, and healthcare utilization patterns that support value-based pricing discussions with national health services. This data becomes critical for market access in countries requiring health economic evidence for reimbursement decisions.

Without the insurance navigation complexity of the US system, European PSPs emphasize disease education, self-management support, and care coordination within existing healthcare pathways. Programs often integrate with general practitioners and specialist clinics to provide supplementary patient education and adherence monitoring.

Digital platforms enable scalable patient engagement while maintaining compliance with promotional boundaries. Educational content, symptom tracking, and medication reminders delivered through smartphone applications represent growing PSP components across European markets.

The fundamental differences reflect underlying healthcare system structures and regulatory philosophies. US programs emphasize market access facilitation within complex commercial insurance frameworks. European programs focus on outcomes optimization within established public health systems.

Both aim to improve adherence and persistence but the strategy aligns with each region’s healthcare system.

Rigorous research demonstrates measurable PSP impact across clinical, economic, and commercial domains.

A comprehensive systematic review of 64 studies found that 66% of adherence-focused PSP interventions reported statistically significant improvement. The most robust evidence comes from specialty medications treating chronic conditions, where PSP participants demonstrate 10-30% higher adherence rates compared to unsupported patients.

Long-term persistence data proves particularly compelling. The HUMIRA Complete analysis tracking patients over 36 months showed sustained benefits: 69% of PSP participants remained on therapy at 12 months versus 55% of controls, with differences persisting through 36-month follow-up.

PSP participants generate 23-35% lower total healthcare costs despite slightly higher pharmacy expenditures, indicating that improved adherence reduces expensive downstream complications. Hospital admission rates among PSP participants show significant reductions, with one analysis estimating $438 million in potential hospital cost savings for adalimumab patients over 36 months.

Cost-per-enrolled-patient metrics range from $500-5000 annually depending on service intensity and therapeutic area complexity. Leading programs achieve 15-40% ROI through reduced abandonment, extended treatment duration, and market share protection.

PSPs measurably impact key commercial outcomes. Time-to-first-fill improvements of 5-6 days directly influence revenue recognition and patient satisfaction. Enrollment rates in well-designed programs reach 60-80% among eligible patients, compared to 8-15% industry averages.

PSPs operate within strict regulatory boundaries requiring sophisticated compliance frameworks.

The US Anti-Kickback Statute prohibits payments intended to influence healthcare decision-making, requiring careful PSP design ensuring patient benefit rather than provider inducement. Safe harbor provisions protect legitimate patient assistance when programs meet specific criteria: income-based eligibility, no linking to provider decisions, and documented medical necessity.

HIPAA compliance enables comprehensive patient data collection but requires appropriate safeguards for protected health information. Companies must implement business associate agreements with PSP vendors, data encryption standards, and breach notification procedures.

European pharmaceutical codes impose stricter limitations on company-patient interactions. The EFPIA guidelines explicitly prohibit remuneration or personal benefits for patients, while programs must demonstrate medical need documentation and avoid promotional messaging.

GDPR requirements mandate explicit consent for personal data processing, data minimization principles, and individual control over information use. European PSPs must implement transparent privacy notices, opt-out mechanisms, and data portability provisions that constrain commercial applications.

Zelthy offers a comprehensive platform for Patient Support Programs, helping pharmaceutical companies streamline PSP operations across regions while maintaining full compliance. Key benefits include:

“A global pharma company used Zelthy’s PSP platform to run disease awareness campaigns and connect patients with treatments. In just 9 months, the initiative drove 500,000+ website visits, generated 80,000+ consultation requests, achieved a 30% visitor-to-appointment conversion, and doubled therapy initiations in target cities.”

Read the full story to see how Zelthy delivers measurable impact for patient engagement campaigns.

Want to explore how Zelthy can transform your PSP operations? Book a demo. Contact us at connect@zelthy.com or send us a DM on LinkedIn for more information.

Dive into our comprehensive collection of blogs covering diverse topics in project management and beyond.

Reach out to us for inquiries, support, or partnership opportunities. We're here to assist you!

Use our convenient contact form to reach out with questions, feedback, or collaboration inquiries.