AI Compliance in Pharma: Regulatory Risks, Monitoring Frameworks, and Governance Models

Prevent risky AI outputs before they ship. Set up continuous compliance monitoring with guardrails, audit trails, and real-time exception handling.

Clinical trials today face unprecedented complexity. Sites juggle multiple studies, sponsors navigate fragmented regulatory landscapes, and patients demand more convenient participation options. Meanwhile, trial costs continue climbing, with Phase III studies averaging $55,716 per day in direct costs according to Tufts CSDD's latest analysis. In this environment, the Clinical Trial Management System (CTMS) has evolved from a simple scheduling tool to the central nervous system of modern clinical research. A CTMS is a software platform that manages trial operations end-to-end, from study planning through closeout, serving as the single source of truth for sponsors, CROs, and sites.

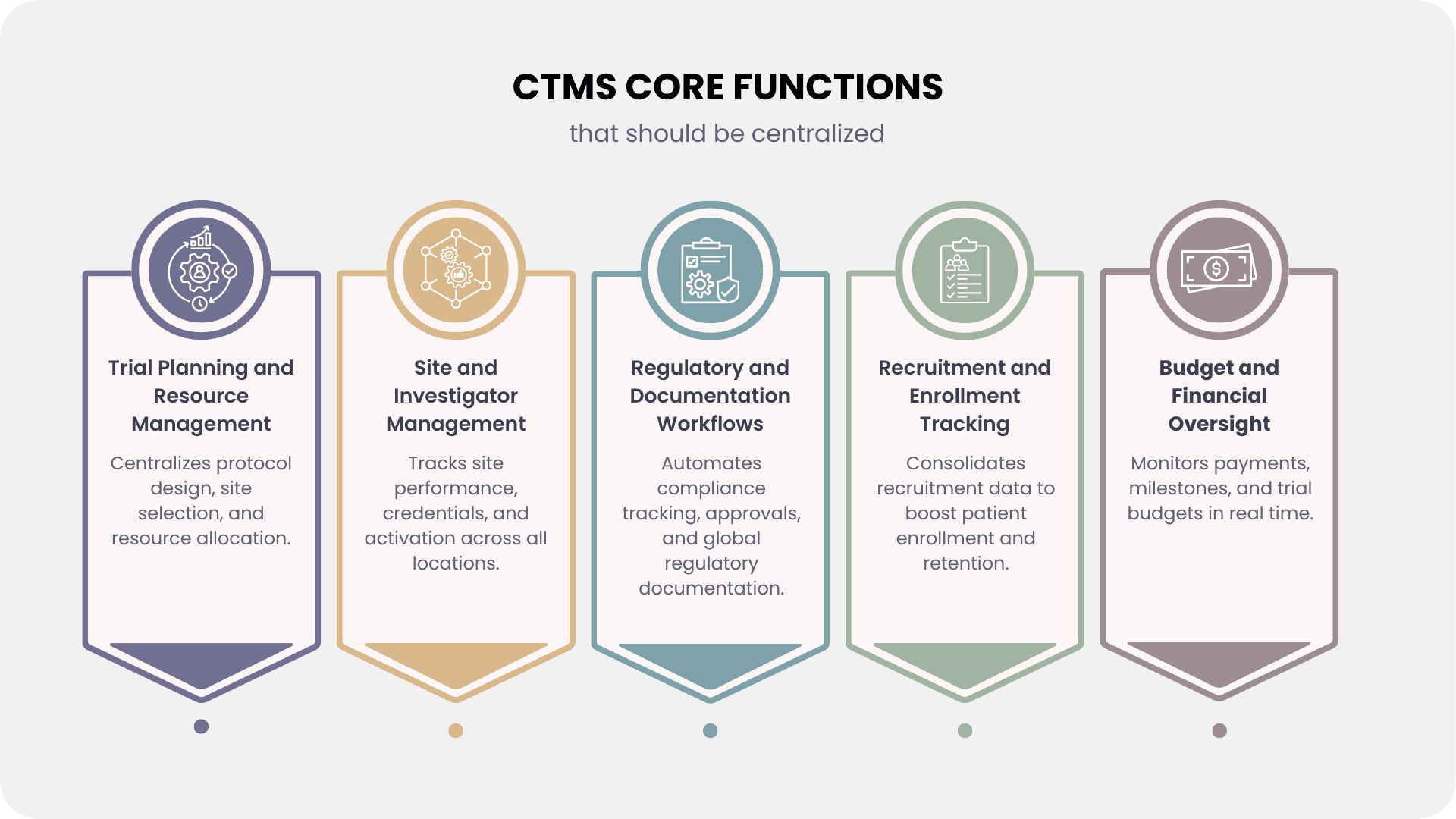

Here's the thing: centralization in CTMS isn't just about convenience anymore—it's about survival in an increasingly competitive and regulated industry. The question isn't whether to centralize, but what must be centralized to maintain competitive advantage and regulatory compliance in 2025.

Every successful trial starts with a robust planning, and a CTMS must centralize the entire process—from protocol development and site selection to resource allocation. Modern CTMS platforms now use AI-driven site selection models that analyze historical data, site capacity, and competitive landscapes that can improve enrollment by 10-20%.

Resource optimization has become critical as trial complexity increases. Studies show the average number of assessments in Phase II and Phase III trials has risen from 17 in the period from 2013 to 2016 to about 21 in the period from 2017 to 2020. A centralized CTMS helps manage staffing, equipment needs, and budget forecasting to prevent resource bottlenecks that can otherwise delay studies by months.

Site management is one of the most complex challenges in clinical trials, and a centralized CTMS provides immediate value by serving as the single repository for investigator credentials, site certifications, training records, and performance metrics across both traditional and virtual sites. Modern platforms go beyond enrollment tracking to monitor activation timelines, data quality, protocol deviations, and patient retention through real-time dashboards, enabling sponsors to quickly spot underperforming sites and take corrective action before timelines are affected.

With rising global compliance demands, centralized documentation workflows are now non-negotiable. A modern CTMS must integrate seamlessly with eTMF systems to manage submission tracking, ethics approvals, and amendment management across multiple jurisdictions. Compliance with evolving guidelines like ICH E6(R3) requires systematic documentation of risk-based strategies, making automated audit trails and monitoring critical. By centralizing regulatory reporting, tracking submission deadlines, and maintaining 21 CFR Part 11–compliant records, CTMS platforms help sponsors ensure efficiency, accuracy, and inspection readiness.

Patient recruitment continues to be the biggest cause of trial delays, particularly as precision medicine and biomarker-defined subpopulations, which are now important to more than half of oncology trials, reduce eligible patient pools. A modern CTMS must consolidate recruitment methods, screening workflows, and enrollment projections across several sites, as well as integrate with EHRs and patient-matching systems to automatically discover candidates. With decentralized models on the increase, platforms should also handle eConsent, remote enrollment, and real-time tracking of funnel metrics, conversion rates, and screen failures in order to constantly improve recruitment efforts.

Clinical trial expenses continue to skyrocket, with a 2016 Tufts study putting the overall cost of bringing a new medication to market at $2.6 billion and phase III trials costing $255 million. Moore et al.'s (BMJ, 2022) more recent investigation revealed lower numbers, with an average per-patient cost of $41,413 and a median pivotal trial cost of $48 million (IQR $20–102 million). While estimates vary, there is no denying that clinical trial costs are significant. In this context, CTMS platforms must consolidate site payments, milestone tracking, and budget variance analysis across several worldwide sites with different currencies and terms. Modern CTMS solutions facilitate proactive cost control, audit-ready financial oversight, and a higher return on trial investments by integrating with procurement systems to capture vendor payments, site fees, and product costs, as well as providing real-time dashboards for budget burn rates and cost-per-patient metrics.

With decentralized clinical trials growing over 400% between 2012 and 2022 (GlobalData), CTMS platforms must now connect seamlessly to ePRO systems, wearables, telehealth, and home health services. Beyond data integration, the goal is to orchestrate hybrid and virtual workflows—managing direct-to-patient shipments, remote visits, and digital biomarker collection—while ensuring engagement, compliance, and data integrity.

Since 2017, the FDA has approved multiple drugs based on real-world evidence (RWE), making RWE integration a CTMS imperative. Using standards like HL7 FHIR, platforms must link EHRs, registries, and trial systems to enable post-market surveillance and comparative effectiveness studies. Centralizing RWE study designs, protocols, and analysis ensures trials align with evolving regulatory expectations.

RBM has shifted from recommendation to necessity under ICH E6(R3). CTMS platforms must provide centralized dashboards with predictive analytics, anomaly detection, and resource allocation tools. This approach improves data quality, strengthens patient safety oversight, and can reduce monitoring costs by up to 30% through targeted interventions.

AI is now a core enabler of faster trials, with leading biopharma companies reporting six-month timeline reductions. CTMS platforms must centralize AI for enrollment prediction, site performance forecasting, and protocol optimization. Machine learning and NLP can forecast risks, extract insights from reports and communications, and support real-time decision-making across the trial lifecycle.

Global regulations like GDPR, HIPAA, and state privacy laws make centralized compliance workflows essential. Modern CTMS must manage consent, cross-border transfers, and subject rights, while enforcing advanced encryption, role-based access, and full audit trails. Failure to comply can result in fines of €20 million or 4% of global turnover, making data security a strategic as well as regulatory priority.

Modern clinical trials demand a system that unifies operations, compliance, and oversight into one platform. Zelthy CTMS is designed to address exactly these needs, helping sponsors and CROs achieve efficiency while staying regulatory-ready.

By consolidating these functions, Zelthy allows trial teams to focus on science and patient outcomes rather than administrative overhead—making it a modern alternative to bulky, generic CTMS platforms. Check out the complete guide on CTMS.

Ready to transform your clinical trial management? Book a demo with our team to see how Zelthy can power your next clinical trial. Feel free to reach out to us at connect@zelthy.com or on LinkedIn.

Dive into our comprehensive collection of blogs covering diverse topics in project management and beyond.

Reach out to us for inquiries, support, or partnership opportunities. We're here to assist you!

Use our convenient contact form to reach out with questions, feedback, or collaboration inquiries.